Saturday, December 13, 2025 – The Powerball lottery has once again defied the odds, creating a nationwide frenzy as the jackpot rolls over yet another time. Following a highly anticipated drawing on Saturday night, lottery officials confirmed that the massive $1.05 billion grand prize went unclaimed, triggering a surge in the jackpot amount for the upcoming week.

This result sets the stage for a historic “Money Monday” on December 15, where the estimated jackpot will climb to a staggering $1.12 Billion. This places the current run among the top tier of largest lottery jackpots in United States history.

In this comprehensive report, we provide the official winning numbers for December 13, a detailed breakdown of the winners who did take home millions, a full analysis of the tax implications for the next jackpot, and essential strategies for players preparing for the next billion-dollar draw.

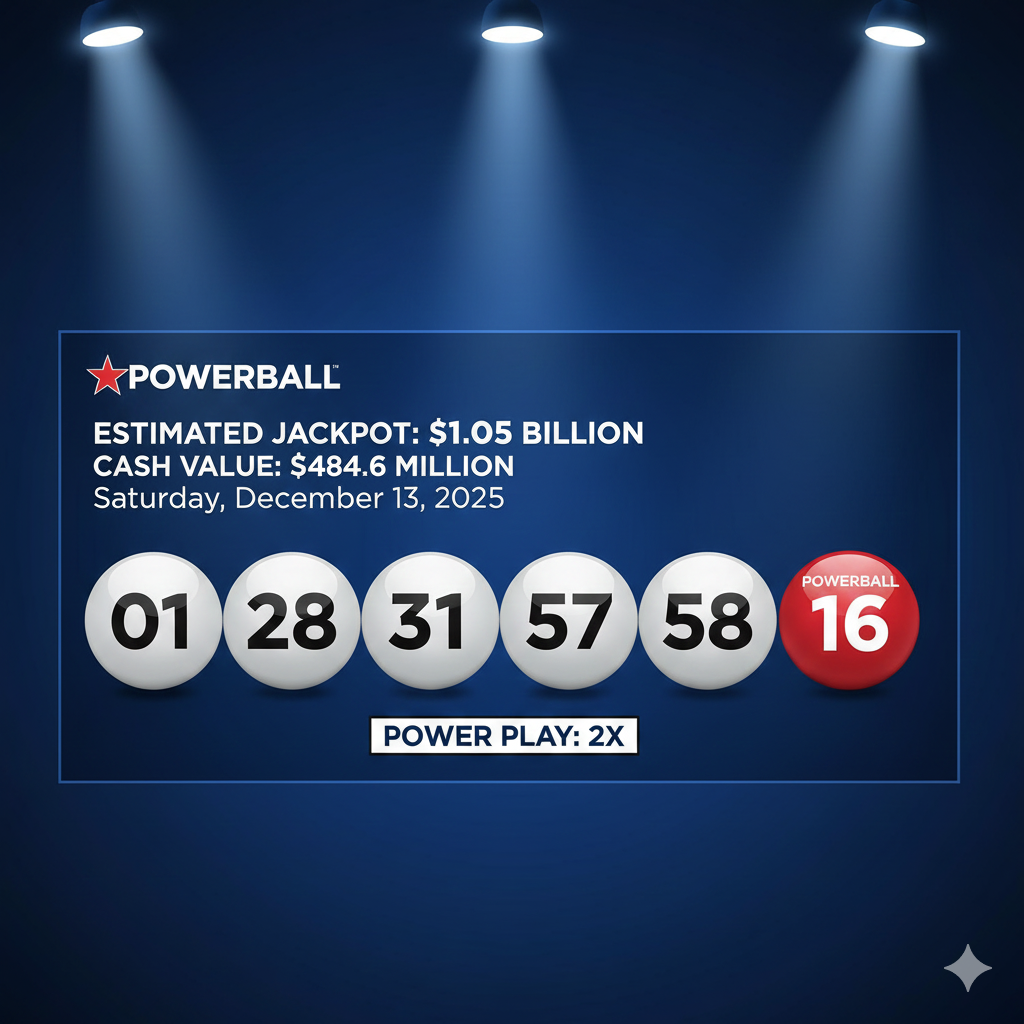

🔴 Official Winning Numbers: December 13, 2025

The drawing took place at the Florida Lottery studio in Tallahassee at 10:59 p.m. ET. If you bought a ticket for the Saturday night draw, verify your numbers carefully below:

Main Powerball Draw

- White Balls: 1 – 28 – 31 – 57 – 58

- Red Powerball: 16

- Power Play Multiplier: 2x

While the jackpot was the main attraction, the Double Play drawing—an optional add-on available in select jurisdictions—also took place immediately afterward. The top prize for this separate draw is $10 million.

Double Play Draw Results

- Winning Numbers: 7 – 11 – 20 – 52 – 60

- Double Play Powerball: 24

💰 Jackpot Update: Crossing the $1.1 Billion Threshold

Since no ticket matched all five white balls plus the red Powerball, the jackpot has rolled over. This is significant because the prize pool grows exponentially as public interest peaks past the billion-dollar mark.

The Forecast for Monday, Dec 15, 2025

For the next drawing, the stakes have been raised significantly:

- Estimated Annuity Jackpot: $1.12 Billion

- Estimated Cash Value: $510.4 Million

The “Cash Value” is the amount of money the lottery currently has on hand to pay the winner. The “Annuity” value is what that cash would be worth if invested in government bonds over 29 years. Approximately 98% of all jackpot winners choose the Cash Option.

🥈 The “Almost” Billionaires: Who Won on Saturday?

Just because the jackpot wasn’t hit doesn’t mean there were no big winners. Saturday’s draw produced millions of dollars in payouts for players who came agonizingly close to the grand prize.

According to the Multi-State Lottery Association, 7 tickets matched all five white balls (Match 5), missing only the red Powerball. These prizes are life-changing in their own right:

$2 Million Winners (Power Play)

Two savvy players in the following states purchased the “Power Play” option for an extra $1. By matching 5 white balls, their standard $1 million prize was doubled to $2 million:

- North Carolina (1 ticket)

- Pennsylvania (1 ticket)

$1 Million Winners

Five other tickets matched the five white balls without the Power Play option, winning the standard second-tier prize of $1 million. These tickets were sold in:

- California

- Florida

- Michigan

- New Jersey

- Virginia

Note for California Players: In California, prize amounts are pari-mutuel, meaning they are determined by sales and the number of winners rather than fixed amounts. Therefore, the payout for the CA winner may differ slightly from the standard $1 million.

💸 Financial Deep Dive: What is $1.12 Billion Actually Worth?

One of the most common questions searched during these historic runs is: “How much will I actually take home?” The advertised $1.12 billion is a gross figure. Let’s break down the reality of the taxes for Monday’s upcoming draw.

1. The Federal Tax Hit

If you choose the Cash Option of ~$510 Million:

- Upfront Withholding (24%): The lottery commission is required by law to withhold 24% for the IRS immediately. That subtracts approximately $122.4 million, leaving you with a check for $387.6 million.

- Final Tax Bill (The Remaining 13%): Since lottery winnings are treated as income, a prize of this magnitude pushes you into the highest federal tax bracket (37%). Come April 2026, you will owe the remaining 13%, which is roughly another $66.3 million.

Net Federal Payout: Approximately $321.3 million (before state taxes).

2. The State Tax Variable

Where you buy your ticket matters immensely. State taxes can range from 0% to nearly 11%.

| State | Tax Rate | Impact on Winnings |

|---|---|---|

| California, Florida, Texas, etc. | 0% | Winner keeps full Federal Net (~$321M) |

| New York | 10.9% | Additional ~$55M deducted |

| New Jersey | 10.75% | Additional ~$54M deducted |

📊 Understanding the Odds: Why Does it Keep Rolling Over?

The current jackpot run has been building for months. Many players wonder why it is so hard to win. The answer lies in the math designed by the lottery organizers.

To win the jackpot, you must match 5 numbers from a pool of 69, AND 1 number from a pool of 26. The mathematical probability of this is 1 in 292,201,338.

Is it harder to win than Mega Millions?

Actually, Powerball odds are slightly better than Mega Millions (which are 1 in 302.6 million). However, the odds are still steep enough to allow jackpots to grow to these billion-dollar levels, which in turn generates massive publicity and ticket sales.

Don’t ignore the lower tiers: While the jackpot is a long shot, the odds of winning any prize are 1 in 24.9. This includes the small $4 break-even prizes which keep players engaged.

🛡️ Strategic Tips for Monday’s Draw

With ticket lines expected to wrap around blocks on Monday evening, here is a strategic guide to ensure you don’t miss out.

1. Beat the “Peak Hour” Rush

The highest volume of ticket sales occurs between 5:00 p.m. and 7:00 p.m. on draw nights. This can overload lottery terminals and cause processing delays. Buy your tickets in the morning or early afternoon on Monday.

2. Know Your Cut-Off Time

Ticket sales do not stop at the exact same time everywhere. While the draw is at 10:59 p.m. ET, sales usually stop 59 minutes prior. However:

- Some states stop sales as early as 9:00 p.m. ET.

- Online lottery courier apps (like Jackpocket) often stop taking orders 1-2 hours before the official cutoff.

3. The Office Pool Protocol

Pooling money with coworkers is a popular way to buy more tickets without spending more money. However, this is also a source of major legal disputes. If you are running a pool:

- Write it down: List the names of everyone who contributed.

- Photocopy the tickets: Send a picture of the group’s tickets to all members before the draw.

- Designate a leader: Only one person should sign the ticket if you win, but they should sign it on behalf of the trust/entity you will form.

❓ Frequently Asked Questions (FAQ)

Q: Has anyone ever won a billion dollars in December?

A: Large jackpots are common in winter, but a billion-dollar win in mid-December would be a unique holiday gift. The largest jackpots historically have fallen in November (Powerball) or January/July (Mega Millions).

Q: What numbers come up the most?

A: While every draw is independent and random, statistically, over the last few years, white balls 61, 32, 21, 63, and 69 have been drawn more frequently than others. The Powerball number 18 is also a frequent flyer.

Q: Can I remain anonymous if I win?

A: Only in a few states (DE, KS, MD, MS, MO, MT, NJ, ND, OH, SC, TX, WY). In most other states, your name and city of residence are public record to ensure transparency.

⚠️ Important Disclaimer & Responsible Gaming

This article is strictly for informational and entertainment purposes. We are not affiliated with the Powerball or the Multi-State Lottery Association (MUSL).

Gambling Addiction is Real: The thrill of a $1.12 billion jackpot can sometimes lead to irresponsible spending. Please remember:

- Never chase losses.

- Lottery tickets are not an investment strategy.

- If you or someone you love has a gambling problem, confidential help is available 24/7. Call or text 1-800-GAMBLER (1-800-426-2537).